Season-end Summary of Shareholder Voting on 14a-8 Proposals

This summary is focused on 14a-8 proposals that were voted on by shareholders during the 2024-2025 season.1 We have a separate package of materials that covers 14a-8 challenges to inclusion brought by companies using no-action letter requests which can be obtained here.

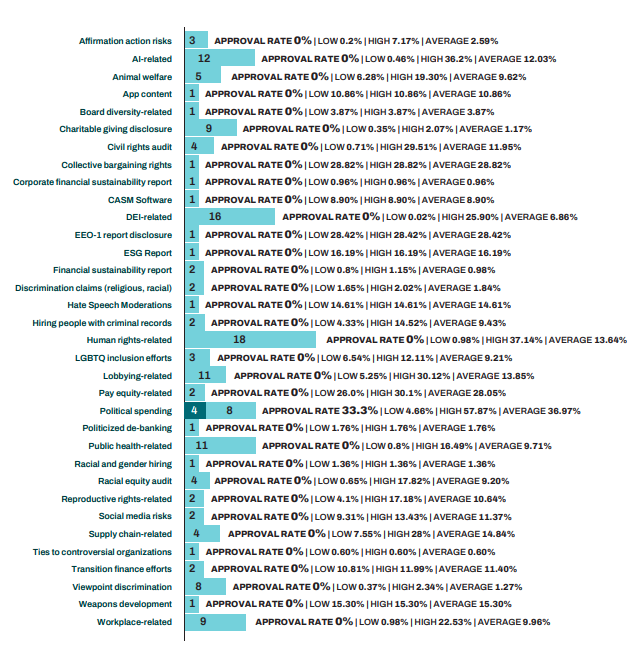

We refer to the accompanying chart which has the supporting detail for what follows. As you’ll see, we divide proposals into five categories consistent with our practice in prior years.

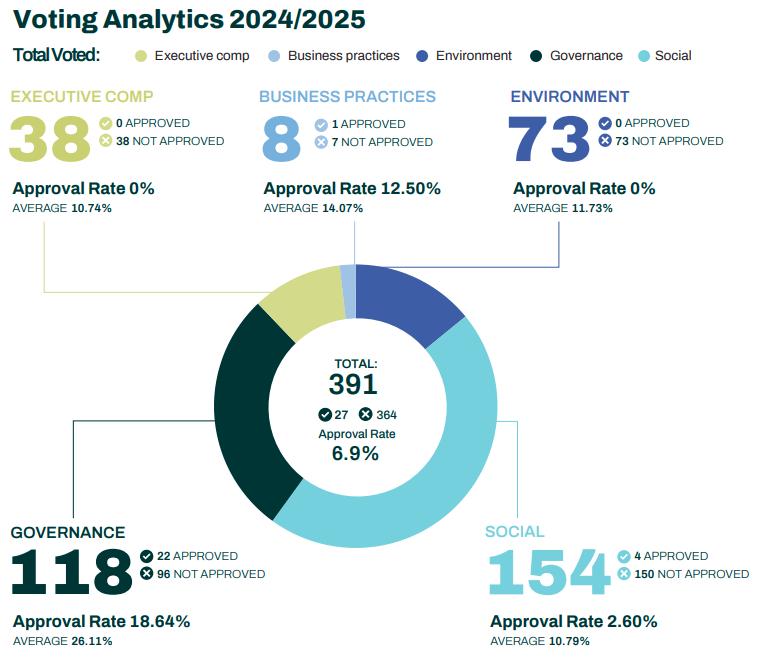

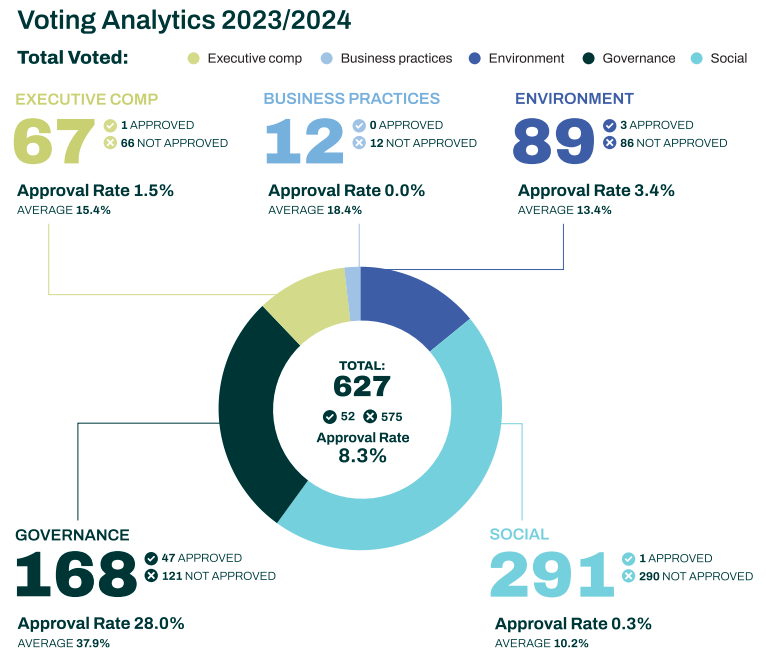

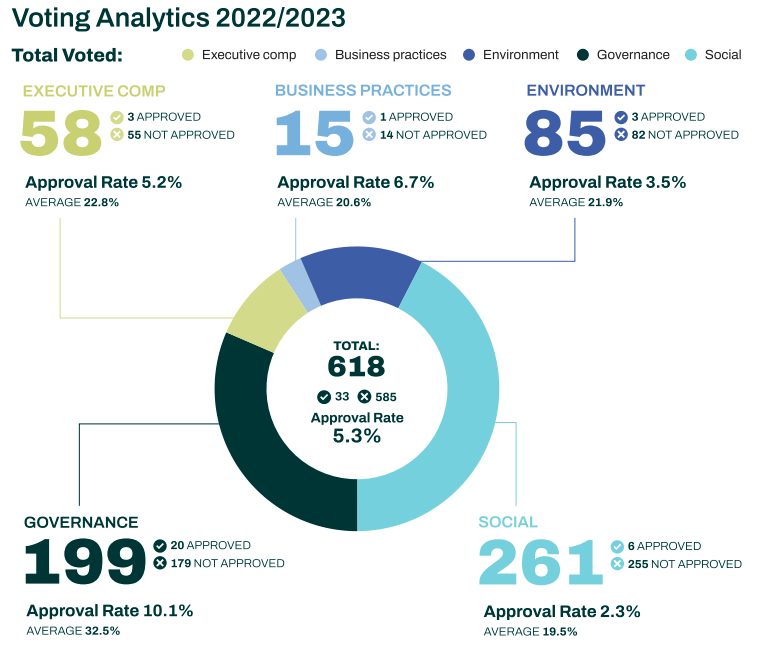

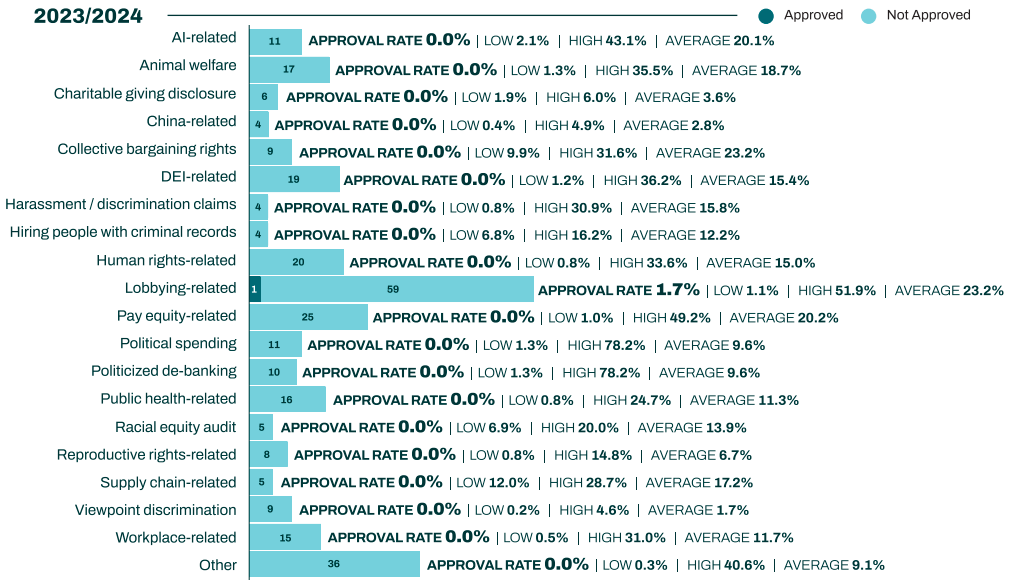

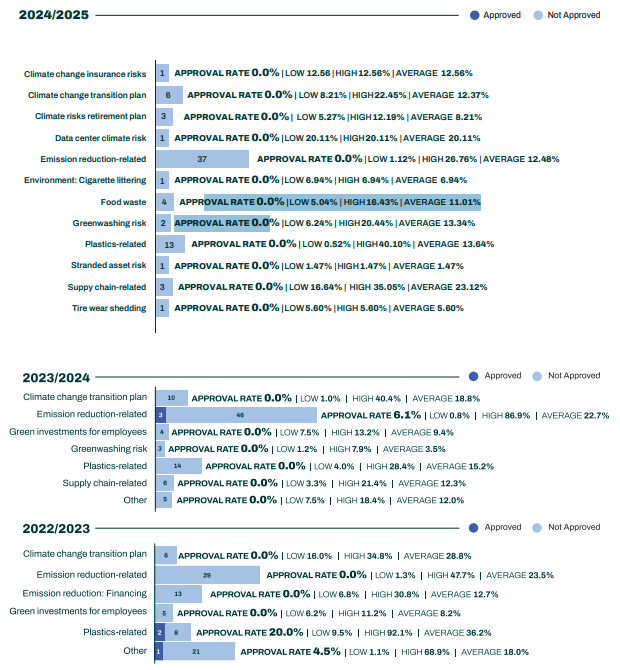

SOCIAL

- The number of Social proposals decreased to 154 from 291 season over season (47.1%), and were 39.3% of all proposals that were voted on this season.

- Average shareholder support had a slight increase season-over-season (10.8% versus 10.2%). It was 19.5% in the 2023-2023 season.

- Only four Social proposals were approved by shareholders this season (2.6%), all related to Political spending.

- The number of Lobbying-related proposals declined from 60 to 11, season-over-season, none of which were approved.

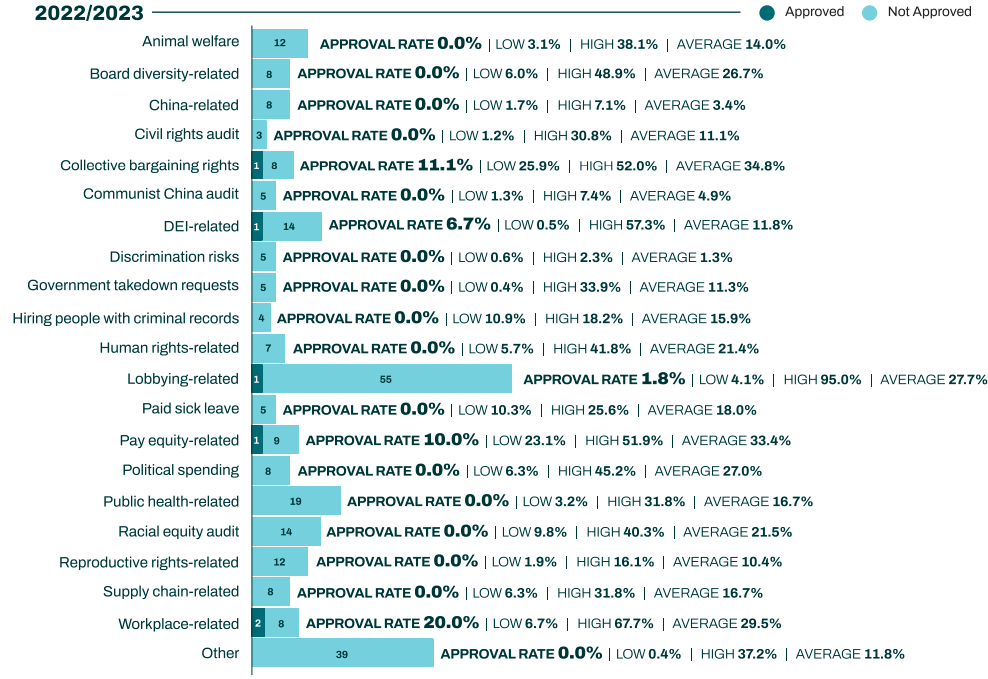

GOVERNANCE

- The number of Governance proposals declined from 168 to 118 season-over-season, a 29.8% drop.

- Average voting support declined from 37.9% to 26.1% season-over-season, a 11.8% drop.

- 22 of the 118 Governance proposals this season were approved (18.64%), compared with 46 of 168 in the 2023-2024 season (25.0%). The 22 that were approved were 81.48% of all proposals approved by shareholders this season, despite Governance proposals only being 30.35% of all the proposals voted on this season.

- Declassify the board stands out among the Governance segments. Nine were voted on this season and eight were approved (88.9%), with average voting support of 78.4%.

- There were 21 Independent board chair proposals this season, 42 in 2023-2024 and 85 in 2022-2023, none of which were approved.

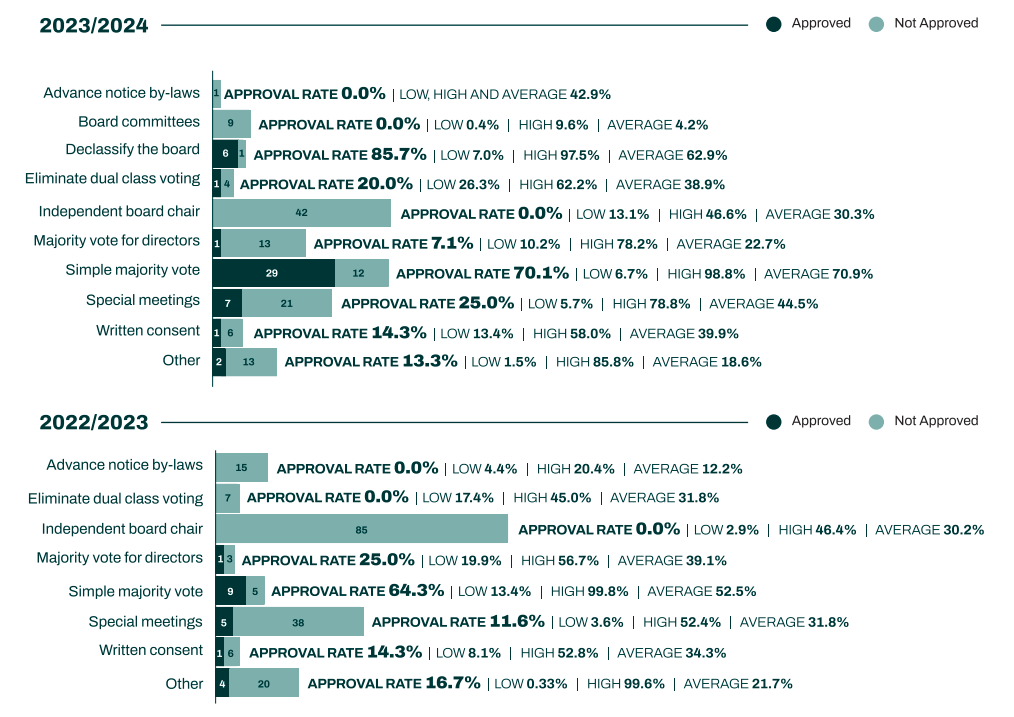

ENVIRONMENT

- There were 73 proposals voted on this season compared with 89 in the prior season.

- None of the 73 were approved by shareholders. Average support was 11.7%.

- 37 of the 73 proposals (50.6%) were Emission reduction-related, none of which were approved by shareholders. On average, Emission reduction-related proposals received 12.5%, down from 22.7% support in 2023-2024.

EXECUTIVE COMPENSATION

- There were 38 proposals voted on this season compared with 67 in 2023-2024 and 58 in 2022-2023.

- None were approved this season, compared with one in 2023-2024 and three in 2022-2023.

- Average shareholder support declined from 15.4% to 10.7% season-over-season.

BUSINESS PRACTICES

There were eight this season, down from 12 last season. One Sell the company proposal was approved this season.

An expensive soapbox?

Until the 2021 change in SEC policy, Governance was the focus of most 14a-8 shareholder proposals. This has shifted to Social proposals, and to some extent to Environment proposals, led by activist umbrella groups such as As You Sow, which this season has sponsored 61 proposals as shown on its website here. As You Sow was the named proponent for 27, none of which were approved.

Our data suggests that institutional investors are tiring of proposals that are extraneous to company business which would explain the drop-off in support for Social proposals (19.5% to 10.2% to 10.8%) and Environment proposals (21.9% to 13.4% to 11.6%). This season only four of 154 Social proposals (2.6%) and none of 73 Environment proposals were approved (0.0%).

We use another database to track challenges brought by companies to exclude proposals submitted by their shareholders per Rule 14a-8, and issued our season-end report thereon on May 16, 2025 available here. This season was complicated by the SEC’s issuing Staff Legal Bulletin 14M mid-season which rescinded SLB 14L. As a result, the number of challenges increased 96% from the 2022/2023 season, especially for those that invoke the (i)(7) ‘ordinary business’ exception which went from 30 in the 2022/2023 season to 58 in the 2023/2024 season, and to 85 in the 2024/2025 season.

While the number of challenges increased significantly their ‘success rate’ went down from 69.8% to 58.3%. In light of the policy shift made by SLB 14M many expected a higher ‘success rate.’ Regardless, none of the proposals that survived an (i)(7) challenge were approved by shareholders, who had the final word.

Notes

- We define the 2024-2025 season as annual shareholder meetings held between July 1, 2024 and June 30, 2025, the 2023-2024 season as annual shareholder meetings held between July 1, 2023 and June 30, 2024 and the 2022-2023 season as shareholder meetings held between June 20, 2022 and July 1, 2023.

- We have an interactive spreadsheet which has the underlying date for this report. It tracked all proposals that were included in annual meeting proxy statements this season.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release