Ector County Home Values Climb 6.8%

O'Connor discusses how Ector County home values climbed by 6.8% in 2025.

ODESSA, TX, UNITED STATES, June 12, 2025 /EINPresswire.com/ -- Ector County is the classic west Texas community. Home to Odessa, renowned for high school football and the oil industry, is generally what outsiders picture when they think of Texas. While neighboring Midland County has an undeserved reputation for being expensive, Ector County has seen a stiff increase in property values and taxes in recent years. In 2025, residential values increased by 7.3%, while commercial properties saw a jump of 6.8%. However, there is plenty of evidence that both numbers have been dramatically overexaggerated by the Ector County Appraisal District (CAD).

Ector County Homes Taxable Value Jumps 6.8%

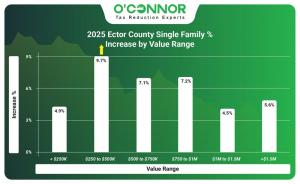

According to Ector CAD, all residential property in the county is worth around $9.11 billion. There was a combined increase of 7.3% across the county in 2025. This was evenly distributed across all home price types, with no noticeable spikes. The majority of total home value was reserved for residences worth $250,000 to $500,000, totaling $4.23 billion. These homes also increased the highest in value with 9.7%. Homes worth less than $250,000 came in second with $3.90 billion.

In keeping with the trend established by the worth of homes, smaller residencies are the norm in Ector County. Residences smaller than 2,000 square feet combined for the biggest total with $4.98 billion. Homes that measured 2,000 to 3,999 square feet came in second with $3.61 billion. These two price ranges saw 2025 increases of 7.8% and 6.6%, respectively. While they account for a much smaller slice of value, large homes all saw positive growth as well.

Ector County is firmly rooted in the past, while also embracing the future. The two largest portions of home value are found in residences built between 2001 and 2020 and those built before 1960. Those built between 1961 and 1980 nabbed the third spot. New construction is quickly taking over however, and already accounts for 11% of all home value in the county, while adding 34.2% more to value in 2025 alone. Residential construction and demand are tied closely to the oil industry, so booms and busts can be tracked through this breakdown as well.

Ector County Homes: Overvalued or Underpriced?

After crunching the numbers, Ector CAD now believes that 70% of all homes are valued correctly or below their fair market value. This means that 30% of all homes are still overvalued. This is an improvement from 2024, where homes were estimated to be overvalued by 41%. While any improvement is a step in the right direction, this means that there is still ample opportunity for property tax appeals to find cuts for taxpayers.

The plot thickens when Ector CAD is fact-checked by outside sources. Navica MLS, a source for realtors that services Midland, Odessa, and the rest of the Petroplex, has revealed that things are not so sunny. According to Navica MLS, home values in Ector County are actually down 6.1%. As these numbers come from home sales, they can reveal the true worth of property. With over a 13% difference between these two sources, it leaves a lot of room for the truth.

Ector County Commercial Properties Ascend 6.8%

The oil and gas industry is not accounted for when commercial property is assessed in Texas. This leaves a big blind spot in communities like Ector County. Even without directly benefiting from the oil business, the numbers for commercial property are on the rise, netting an increase of 6.8% in 2025. Of the combined $4.01 billion, $2.05 billion in value came from businesses worth $5 million or more. Commercial property worth $1 million to $5 million achieved second place with $1.02 billion. Businesses in this price range saw the largest increase in percentage with 8.8%.

When commercial property is broken down by type, it can be seen that the majority of value is centered between offices and apartment buildings. Offices have been the top dogs for a while, with a value of $1.66 billion, even growing 2.2% in 2025. Apartments closed the gap in 2025, growing by 15.5% to $1.02 billion. While the total is not close to apartments or offices, hotels saw a giant jump of 20.1%. Like residential properties, the commercial zone’s value is at the mercy of the oil industry when it comes to long-term growth.

The influence of oil booms and busts can be seen in the age of construction for commercial properties across Ector County. 46% of all commercial property value was built between 2001 and 2021. While this trend is generally followed in Texas, it is particularly pronounced in Odessa, Midland, and other oil-rich cities. A good batch of value was also created between 1961 and 1980. While only a fraction of older property, new construction had a banner year in 2025, with a growth rate of 18.6%. Buildings constructed after 2021 now account for 3% of all commercial value.

An Outside Perspective

In another connection to home prices, an outside study reveals that commercial values may be overstated as well. Green Street Real Estate released an analysis of commercial properties across America. They discovered that, as a whole, commercial properties are down 21% from their 2022 high. This is caused by many factors, including bonds looking like better investments than property, rising interest rates, and difficulty borrowing. It should be noted that this is a nationwide study, so it could not accurately reflect the value of Ector County or other Texas areas.

Apartments Rise 15.5%

Apartments are often the largest commercial property type in Texas. While this is not true in Ector County, they are quickly keeping pace with offices for the top spot. Apartments were able to appreciate by 15.5% in 2025 alone. Most of the apartment value was built in the boom years of 2001 to 2020, totaling 46% of the total. The biggest jump in both worth and percentage was for apartments built between 1961 and 1980, which spiked by 32% to $313.79 million. New construction saw a small loss in value.

Ector CAD divides apartments into generic apartments, charitable housing, and garden apartments. Generic apartments are the biggest block by a wide margin, even adding to their lead with 16.3% more value in 2025. Charitable housing lost 1.5% of value, while garden apartments edged up 2.9%.

Offices Still Wear the Crown

Offices continue to be the No. 1 source of commercial value in Ector County. With a combined $1.66 billion in value, they were able to add to their lead by 2.2%. The initial creation of this value can be tracked to the two boom periods of record. 51% was built between 2001 and 2020, while 27% was constructed between 1961 and 1980. New construction added 12.8% more value in 2025, which translates into 3% of all value created from offices.

While some appraisal districts go into depth about the type of offices their county has, Ector CAD only uses two. When seen as office buildings and medical offices, there is a clear advantage for generic offices. Medical offices saw a tiny regression with a loss of .1%, while office buildings added 2.4%.

Ector Retail Keeps Increasing

While online shopping and the pandemic both took large bites out of retail spaces, there has been a renaissance in recent years. Ector County has had solid growth in the retail sector for the past few years. 9% of all retail value was built after 2021, showing that this is new construction, not just a post-pandemic bounce. While new construction added 24.1% to their value, the two older retail brackets saw minor losses. Even more recent construction was stagnant or added just a bit of growth. It appears that Ector County is going on a modernization spree when it comes to commercial property.

While retail properties may not be broken down into a litany of subtypes, the two chosen are pretty illustrative. While both types are close to even when it comes to the total value, strip shopping centers are in the lead with $199.45 million. Single-occupancy tenants, also known as big box stores, still notched a solid $150.08 million. Strip centers opened their lead by growing 3% in 2025.

Warehouses Keep Appreciating

The oil industry requires a lot of storage space and equipment. While oil storage is not counted as commercial property, standard warehouses are. Usually one of the most reliable types of commercial structures, warehouses in Ector County do not disappoint. Warehouses as a whole were able to add 6% to their total in 2025. While the boom period between 2001 and 2020 accounts for 36% of all value constructed, things are spread more evenly than other commercial types. Growth rates were almost identical among all timeframes, with the exception of 20.5% for new construction.

Ector CAD breaks down warehouses into three subtypes. General warehouses got the lion’s share of value at $462.71 million, adding to their commanding position with 6.9% growth. Mini warehouses were in second place with $61.55 million, while office warehouses totaled $5.72 million.

Ector County in Review

Ector County has traditionally been built upon the ebb and flow of the oil industry and this trend seems to still be in full effect. There has been clear growth in both the value of homes and commercial properties. This is without regard for the value of oil-producing property. A spate of new construction and modernization is a good sign for Ector County, as it appears that fortunes are on the rise.

There is always room for improvement and the unreliability of Ector CAD’s numbers can be a concern for business and homeowners. Being a county that is focused on working people, there is little margin for error when it comes to families staying in their homes. An inflated tax bill can be devastating, even if it is off by only a few hundred dollars. This is why protests need to be used by more residents of Ector County and beyond. It is a right guaranteed under the Texas Constitution and everyone should exercise this right if they are able.

Due to uncertainty in the economy, especially one that is streaky and dependent on oil, it is imperative that property values are looked at under a magnifying glass. O’Connor can help you achieve this by protesting your taxes annually. There are no upfront costs, hidden fees, or legal costs. You will only pay if we lower your taxes. Let O’Connor worry about the whims of the market, while you focus on your business or family.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release